Choosing the Best Prescription Drug Plan

- Brad Gunning

- Oct 3, 2016

- 2 min read

Updated: May 22, 2019

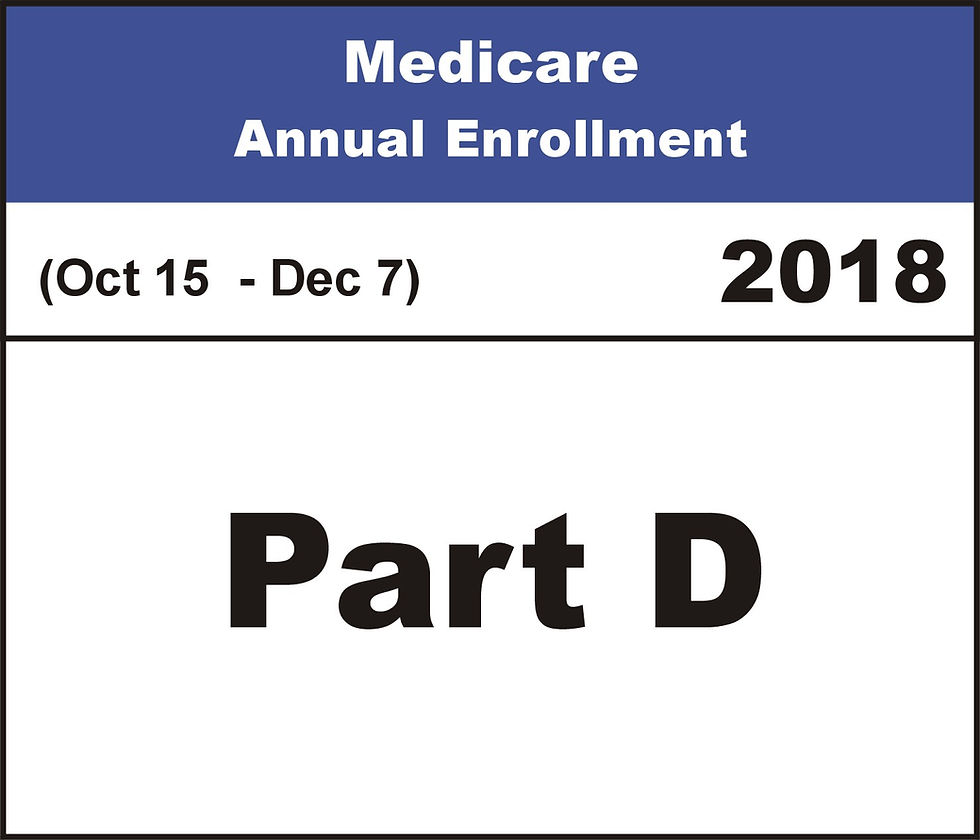

Plan D Prescription Drug Plan Open Enrollment begins October 15. If you're in the market for a prescription drug plan, you might be wondering how to go about choosing the best plan.

If You Aren't Currently on Meds, Should You Still Buy a Prescription Drug Plan?

If you're 65 years old, does it make sense to purchase a prescription drug plan during Open Enrollment? Yes, if you are not currently on any prescriptions, you should still buy a prescription drug plan. The reason is twofold:

1. You will be penalized about 1% per month you weren't enrolled in a prescription drug plan when you eventually sign up.

2. If you don't have a plan and eventually develop a medical condition that requires an expensive drug, you will not be able to sign up until the October 15 open enrollment. This can be extremely expensive if you are prescribed an expensive drug early in the year.

If you currently aren't taking any prescription drugs, there are some very low premium options available. We can run quotes for you and sign you up in a matter of minutes over the phone.

If You Are On Meds, How Do You Know Which Prescription Drug Plan is Best?

If you contact one of our agents, we can take your prescriptions and dosages and calculate the lowest cost plan when COMBINING the cost of drugs plus the insurance premium. Sometimes the cheap $18 or $25 plans are significantly more expensive when you take into account the cost of the drugs.

We have seen the whole spectrum here: Sometimes a no deductible plan is best, sometimes the lowest premium plan, and sometimes a $60 plan ends up saving a person thousands when taking the cost of drugs into account. It varies significantly based on what prescriptions a person takes.

For this reason it is important to have an insurance agent run a free comparison for you.

Nobody could ever describe this article the way you did, i really would appreciate if you could write about where to Buy percocet online no prescription, does it have any side effects?